The most important types of business organizations are Joint Stock Company. Thus the importance of Joint Stock Company is increasing day by day because at present one cannot run mega companies.

A joint stock company is an association of individuals called stockholders or shareholders. They are authorized by the government to run particular business. So Joint Stock Company has the following features.

1. All the shareholders share the ownership of the form.

2. Liability of a shareholder is limited which depends on the extent of the shares he holds in the company.

3. While a paid manager takes the managerial responsibility. But these managers are supervised by a small group of shareholders . Which is called Board of Directors.

4. The joint stock company has a separate existence and legal personality. It is different from the shareholders.

5. The shares of the company can be bought or sold in the stock market. So that the ownership of the company can be transfer from one person to other. Hence shares can be transferred from one person to other. Therefore investor need not to stick in one company.

Benefits of Joint Stock Company.

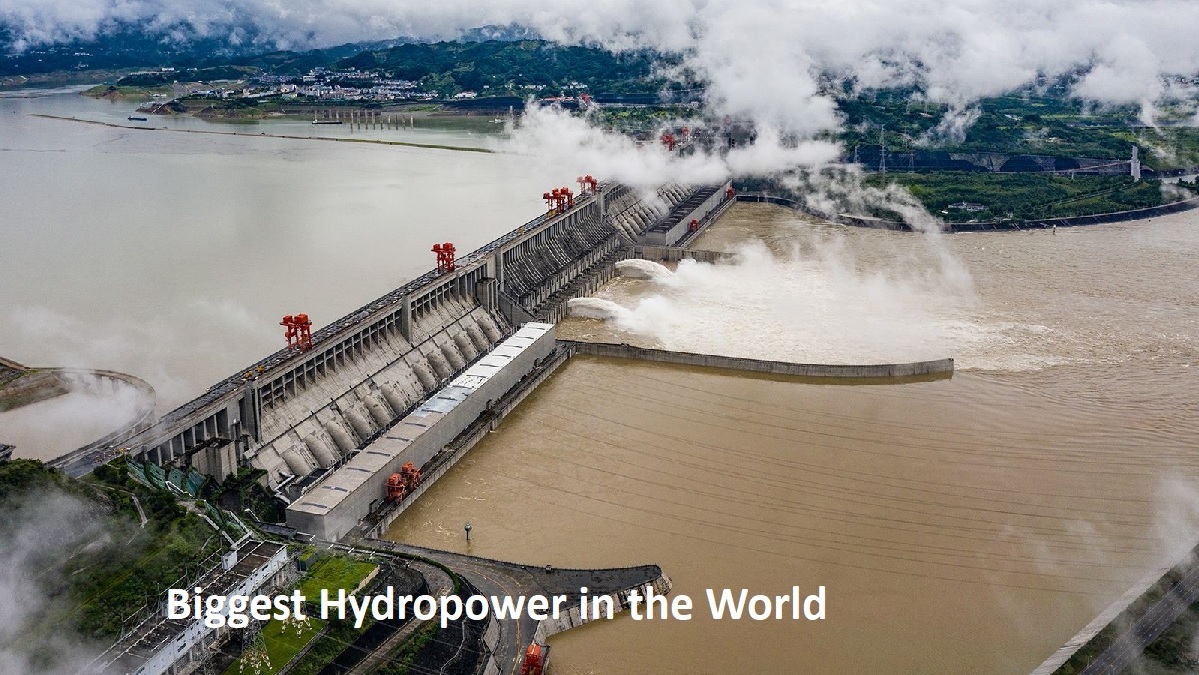

Large Funds: Probably the most important advantage of Joint Stock Company is that it commands large funds. It can get funds from general public, in different forms such as public shares and bonds.

Sometimes it can get funds from other countries. If foreign nationals buy the shares of company. In such way joint stock company collects funds.

Limited Liability: The liability of owners is limited. But in case of individual and partnership liability of members is unlimited. This this is the serious disadvantage for both organizations. The liability of shareholders is limited to the amount of their shares.

Shares Transferable: The shareholders can sell or buy the shares of Joint Stock Company. So it is the convenient way of investment. Therefore they are not tied for the fortune of company throughout their life.

Economical Administration: The directors are not paid salaries. They just get fee for board meeting. Thus a company can get the advice of mature and wise people at low cost. It means the administration cost is economic. But the other allowances are high.

Democratic: The shareholders can remove the directors if they are not found satisfactory. Therefor the company is democratic. The supreme power goes to shareholders. Shareholdr

The company has a perpetual existence: Some shareholders may leave the company but it goes on. Hence in long run the company can also run enterprises which may reach the stage of profit.

Thrift Encouraged: The company affords opportunities of investments to the people of small means. Hence this type of company helps in capital formation for the nations. Which helps to reduce inflation. Therefore it is good for economy.

Legal Control: The function of the company is controlled by the government. So it has to conform certain legal requirements.

The objective of the company is to prevent fraud. Which will protect the interest of the shareholders and the public at large.

Risks Spread Out:

This type of organization enables the individual investors to spread out their investment. It is not necessary to invest all amounts in one company.

That means investors need not to keep all eggs in the same basket. Which enables the investor to invest in number of such companies. This reduce the risk of investors.

Wealth and Power: This type of company has serious disadvantages from the point of view of the country as a whole. Some rich and powerful financiers can hold the entire banking and insurance sector of the country.

Therefore they can keep the economy of the country in their grip. So the economy may go down.

b. Control by Small Groups: The joint stock company is controlled by small group of people. Which is called board of directors. In theory the board of directors are controlled by public shareholders. But it is not so in real practice.

c. Separation of Ownership and Control: There is a separation between ownership and management. While the risk of the company is bearded by the shareholders. But the manager of the company have no share in profit.

d. Not Efficient: Individual and Partnership Company are fast. But these type of organization are found little slow in decision making process. There is no touch between employee and the shareholders. Therefore employee performance is sometime not efficient.

Drawbacks of Joint Stock Company.

e. Defects of limited Liability: There is principle of limited liability. While the joint stock company has two serious defects. Firstly the directors may become irresponsible because they have limited shares.

Secondly the shareholders may not take much interest about the organization. This further encourages the directors to be more powerful. While Directors are not responsible.

You Might Also Like:

[button-red url=”https://drive.google.com/drive/folders/0BynHCk9e1OUNVlNTRGNrTjZxMWs” target=”” position=”left”]See Here Information About Joint Venture Companies Nepal[/button-red]