Employee provident fund (EPF) is also known as Karmachari Sanchya Kosh. Which was established on 2019 BS to secure the retired life of the employee. Before this there were not such types of organization in Nepal.

While there is an interesting incident which gave birth to EPF Nepal. A policeman got age retirement from his job. On the day when he got retirement he had not a single penny in his pocket. Even he had not got travel money to reach the home. Hence this incident compelled the policy maker to think about EPF Nepal.

But now the time has change. Due to EPF Nepal none of the employee should face such problems. Today each contributor of EPF Nepal gets handsome amount at the time of retirement.

Who can join EPF Nepal?

- All civil servant of Nepal government.

- Nepal army persons.

- All employee of Nepal police.

- Armed Police Force employee and

- Any interested private sectors employee.

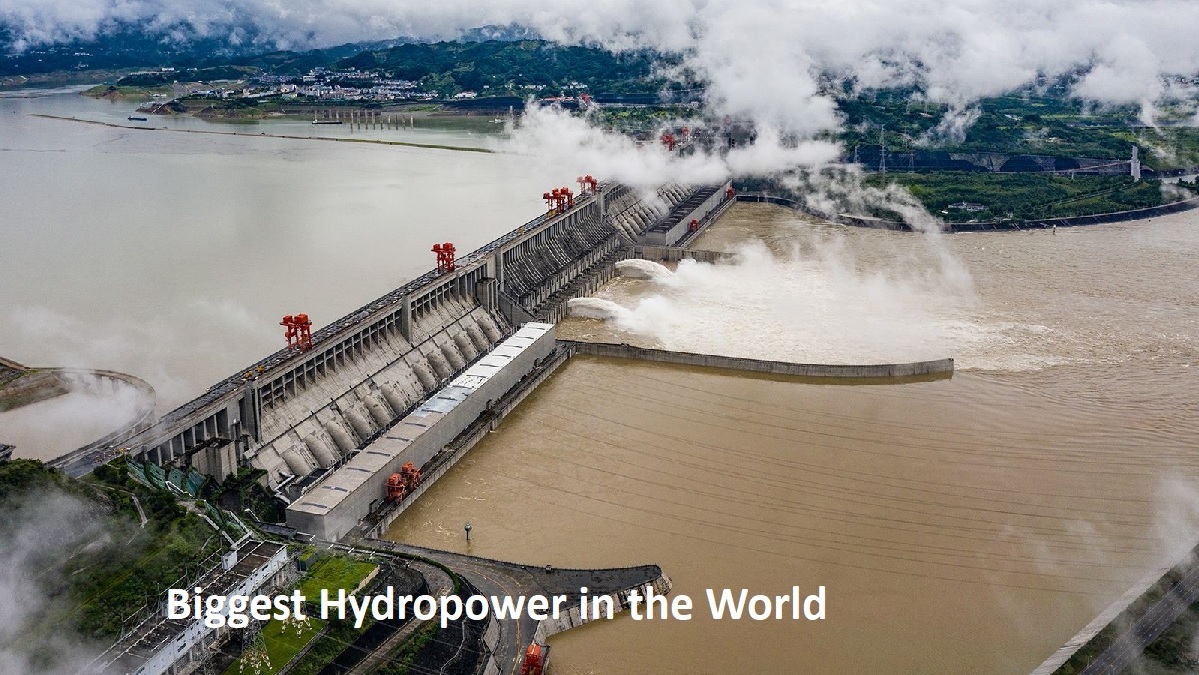

In addition to this EPF Nepal has great role in capital formation . EPF Nepal has huge amount of money collected from more than five lakh employee. Hence this amount can be used for various development projects. Currently it has invested few billions rupees in UPPER TAMAKOSHI HYDROPOWER PROJECT. This is an example only.

It has invested on several other projects as well. EPF Nepal has made many commercial building in major cities of Nepal. These building are given in rent. So the profit thus obtained is distributed proportionally to the contributors.

Similarly EPF Nepal gives home loan to it contributors at low interest rate. The main purpose of this loan is to secure the residential home to its contributors.

Employee Provident Fund Nepal at Glance

- Total Contributors 5 lakh

- Total Contributing Offices 30,000

- Provident Fund 187,565,345,097

- Reserve Fund4, 628,002,008

- Other Liabilities & Provision 2,249,899,634

- Loan to Contributors 104,115,956,474

- Project Loan 24,819,626,114

- Fixed Deposit in Banks 36,870,000,000

- Government Bond 15,226,398,358

- Investment in Shares 2,220,530,741

- Investment in Buildings & Fixed Assets 1,108,609,696

- Other Assets 2,065,182,64

Where are offices of EPF in Nepal ?

Employees Provident Fund

Central Office

Pulchowk, Lalitpur, Nepal

Contact: +977 – 01 – 5010165

Email: [email protected]

Main Office, Thamel

Tridevi Marg, Thamel, Kathmandu

Contact: +977 – 01 – 4223320

Branch Offices

Biratnagar

Contact: 021- 472784

Email: [email protected]

Dhankuta

Contact: 026 – 200049

Email: [email protected]

Hetauda

Contact: 057 – 524377

Email: [email protected]

Pokhara

Contact: 061 – 526811

Email: [email protected]

Butwal

Contact: 071 – 551518

Email: [email protected]

Kohalpur

Contact: 081 – 541282

Email: [email protected]

Surkhet

Contact: 083 – 523066

Email: [email protected]

Dhangadhi

Contact: 091 – 520692

Email: [email protected]

Service Centers

Singhadurbar, Kathmandu

Contact: 01 – 4200466

Email: [email protected]

Central Office, Pulchowk, Lalitpur

Contact: 01 – 5010165

Email: [email protected]

The contributors can contact to the nearest office of EPF. The services given by EPF is fast and effective. similarly the loan procedure is easy and quick. Contributors can take different types of loans. Also the contributors can take online service to check the deposit and statement.