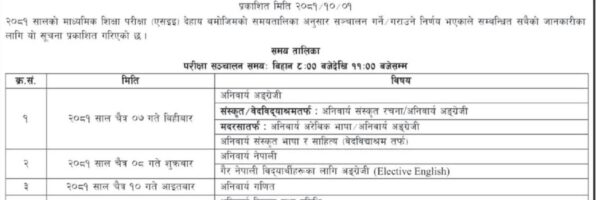

Here is new Income Tax Rate in Nepal. It is according to the budget announcement for the fiscal year 2079/080.

Income Tax Rate in Nepal

Table of Contents

The income tax slab for the unmarried Nepali resident is as follow.

| Annual Income | Income Tax Rate ( 2079/080) |

| Up to Rs. 5 lakhs | 1% |

| Rs. 5 lakhs to 7 lakhs | 10 % |

| Rs. 7 lakhs to 8 lakhs | 20% |

| Rs. 8 lakhs to 15 lakhs | 30 % |

| Above 15 lakhs | 36 % |

Income Tax for the married couple

Married couples get one lakh more in the tax threshold. The detail of the income tax rate for the married couple in the fiscal year 2079/080 is as follow.

| Annual Income | Income Tax Rate ( 2079/080) |

| Up to Rs. 6 lakhs | 1% |

| Rs. 6 lakhs to 8 lakhs | 10 % |

| Rs. 8 lakhs to 9 lakhs | 20% |

| Rs. 9 lakhs to 15 lakhs | 30 % |

| Above 15 lakhs | 36 % |

This income tax rate was not reviewed in the past fiscal year. This year government has increased the salary for the civil servants by 15 percent. This rise in salary will automatically increase the annual income of tax payer. Hence to save them from high income tax rate it is reviewed this year.

Budget Details

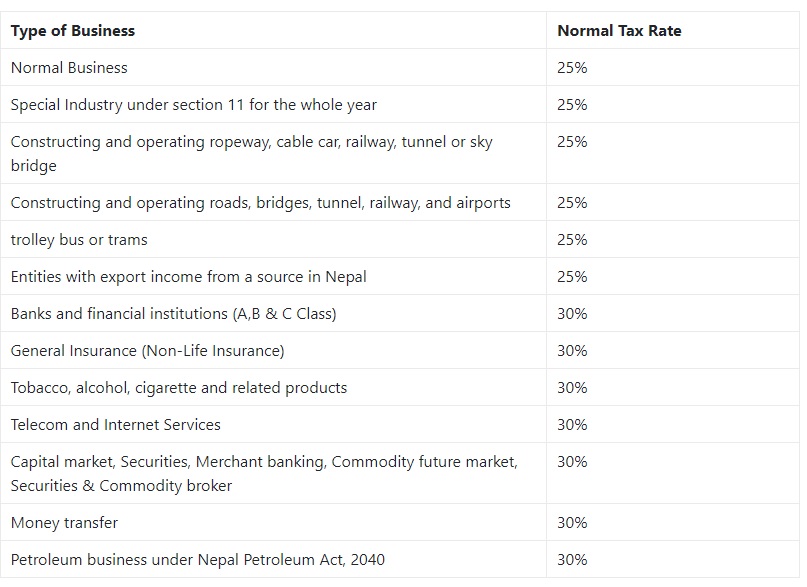

Tax Rate for Non Resident People

| Income earned from normal transactions | 25% | |

| Income earned providing shipping, air transport or telecom services, postage, satellite and optical fiber project | 5% | |

| Income earned providing shipping, air transport or telecom services within the territory of Nepal | 2% | |

| Repatriation of profit by Foreign Permanent Establishment | 5% | |

In the budgets of the fiscal year 2079/080 there are several area getting tax discounts. Government has announced such facility for the pandemic affected industries.

The details about it are available in the budget announcement. Similarly the official page of Inland Revenue will provide more information about tax system in Nepal.

Finally if you have any question about the income tax systems in Nepal leave your question in the comment box below. Our team will reply it within one working day.